You must have a NET worth of over $1,000,000 (not including Primary Residence) OR an annual income of $200,000 ($300,000 if married) for the past two years, with the expectation that this will be true in the current year. We only work with Accredited Investors, and you must agree to indemnify us if your representation is mistaken or fraudulent.

If you have at least $2MM liquid, and want to earn up to a 37.5% rate of return, our Wall Street Investment Program will be of interest. This program works best if you have perfect credit, as it does involve leveraging your investment.

Our program involves the purchase of a quality business with a net profit of at least $2MM, acquired with leverage, and managed by SanctaFide Business Management Services LLC.

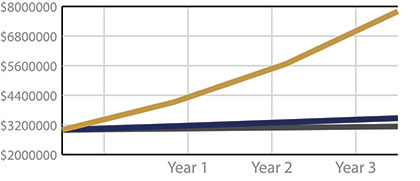

Year-end balances assuming all returns re-invested ($3MM investment):

Year 1: $4,125,000

Year 2: $5,671,875

Year 3: $7,798,878

The great success of our program depends on our skill and tenacity in locating businesses with a history of

consistently increasing revenues and profits. While the theory is not advanced, the execution is very difficult for anyone else to duplicate. Our staff sort through thousands of prospects to find the perfect match for you.

If you have at least $500,000 liquid, and want to earn up to a 30% cash-on-cash return, our Main Street Investment Program will be of interest. Investments between $500,000 and $999,999 will earn a 25%

cash-on-cash return, and investments of $1,000,000 and up will earn a 30% cash-on-cash return.

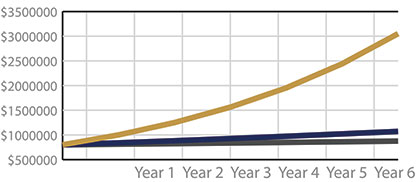

To appreciate the significance of these numbers, here is what the year-end balances would be for a $1,000,000 investment, assuming all returns were re-invested:

Year 1: $1,300,000

Year 2: $1,615,000

Year 3: $1,945,750

Year 4: $2,293,038

Year 5: $2,657,690

Year 6: $3,040,574

Whether you are buying (including add-ons) or selling (including divisions) SanctaFide is your best choice. We will sell FASTER, and for a HIGHER PRICE, while maintaining the highest ethical standards for confidentiality and professionalism.

1- Nationwide, only about 25-30% of Exits are successful, defined as a sale at or above the true valuation and within 2-3 months (Main Street) or 3-4 months (Wall Street). SanctaFide’s rate is over 85%.

2- Depending on the Skill Level of your M&A Advisor, the net proceeds can vary by as much as 40-50%. Even if you have to pay a slightly higher fee, isn’t it worth it when you can NET a far greater amount?

3- Numerous studies have shown that there is a direct correlation between M&A Fees and net proceeds. In other words, sellers who use discount advisors are likely to receive below average NET returns, while sellers who use premium advisors such as SanctaFide are likely to receive well above average NET returns. At SanctaFide, our Due Diligence and Sale Preparation procedures are so rigorous they go beyond exhaustive!

We have many registered buyers and a full time marketing team to get your business sold FASTER and for the HIGHEST price. Please note that we only list businesses that net at least $250K, and this profit must include the expense of a full-time Manager.

While many of our Main Street Businesses sell to buyers who want to operate the businesses they purchase, a significant number are sold within our Accredited Investors Program (AIP). These buyers purchase groups of Main Street Businesses, and usually hire a Manager such as SanctaFide to manage them.

The SanctaFide Commercial Real Estate group offers services in the following areas:

1- Landlord/Tenant (Both Residential and Commercial)

2- Buying or Selling Commercial Property

3- Property Management (Both Residential and Commercial)

4- Accredited Investors Program (Commercial Real Estate) ($2.5MM Minimum)

5- Accredited Investors Program (Commercial Real Estate Development) ($10MM Minimum)

SanctaFide has relationships with Banks, Commercial Brokers, and Ultra High Net Worth Investors who can finance your acquisitions of Businesses or Commercial Property.

Our standard fee is 1.5 Points, with a 1 Point rate for deals where SanctaFide is a participant in the underlying transaction.

For truly outstanding opportunities, SanctaFide can also provide Venture Debt, with either its own funds or the funds of the many VCs we represent.

The source of the investor’s capital must be proven to have been obtained lawfully. If the capital is sent to the investor as a gift then the same process applies to the provider of the gift.

The legal ranges for EB-5 investments can depend on location, but in our foreign investor program, we exclusively offer investments valued at $1,000,000 and above.

The investment must directly or indirectly generate ten full-time jobs within 2.5 years of the approved I-526 form (the conditional green card petition), or show a reasonable projection that these positions will be created and filled. These jobs do not include the investor, his/her family members, or non-immigrant aliens.

This is not a passive investment. The investor must either actively manage or oversee a management structure which he or she implemented.

The business acquired must have been created after November 29th, 1990. If it was formed before this date then there must be a restructuring that results in a new enterprise. The vast majority of businesses we have sold to foreign investors were already considered new enterprises.

We meet or speak with you to discuss your goals as a foreign investor. We partner with our legal team to verify your eligibility and answer your questions about the proposed investment.

At the time of the investment, an I-526 form is filed with an immigration attorney; its purpose is to establish your basis for applying for the actual EB-5 Visa. Depending on where you are, the I-526 takes between 12-18 months to be approved.

When the I-526 is approved and you do not already have lawful status in the U.S., you then apply for a Visa using the DS-230. If you already have immigrant status, then you apply to adjust your status to conditional permanent resident using the I-485.

When the form in the above step is approved, the visa granted is conditional and depends on the investment and investor meeting the EB-5 requirements during the initial two year period. The conditional green card affords you the same benefits as a permanent one, so you and your spouse can legally work and your children can attend school.

In the last 90 days of this two year period, you file an I-829, which petitions to lift the conditional status and when approved, grants unconditional permanent residency.

1- Our secular Mission Statement:

SanctaFide provides the finest Buy-Sell-Manage-Finance-Insure Services through highly trained, hardworking, and extremely diligent employees and independent contractors who are relentless in their pursuit of the best and most ethical outcomes for their clients.

All employees are encouraged to volunteer in their communities, and are offered up to 3 paid hours per month to do this. Also, any employee or independent contractor can choose to donate up to 5% of their fees to a recognized charity, and SFMA will match this contribution.

2- The Regal Commandment:

“Do for others what you want them to do for you: this is the meaning of the Law of Moses and of the teachings of the prophets” (Matthew 7:12)

3- Micah 6:8:

He has shown you, O mortal, what is good. And what does the LORD require of you? To act justly, to love mercy, and to walk humbly with your God.

4- Anti-Discrimination Policies:

SFMA is an equal opportunity employer, and is happy to employ and work with people of all backgrounds. We are ultra-proud of our diverse workforce and clientele. Staff and Clients are encouraged to report any violations immediately.

Winston-Salem Office:

336-652-2000

1365 Westgate Center Dr

Unit C2

Winston Salem NC, 27103

Greensboro Office:

336-808-7800

717 Green Valley Road

Suite 200

Greensboro, NC 27408

Charlotte Office:

704-264-2860

101 N Tryon St

Suite 112 and 6000

Charlotte, NC 28246

Raleigh Office:

919-785-6000

2500 Regency Parkway

Cary, NC 27518